Out now: New study about European pharma dependencies on China

China supplies the majority of our active pharmaceutical ingredients — but what happens if the supply stops? We have conducted a stress test and show that China could be willing to use our dependency strategically. Why political action is needed now, and what levers are available - find out!

Read the full study (in German) here.

China’s Path: From the World’s Workshop to the World’s Pharmacy

China’s rise to become the leading producer of generic drugs is no coincidence — it is the result of a strategic industrial policy. Thanks to multi-billion-dollar support programs and a protectionist economic approach, the country has not only achieved self-sufficiency but has also created dependence among other nations.

Originally, China aimed merely to supply its own population and free itself from reliance on foreign sources. In the field of generics, that goal has now been reached. China has also deliberately expanded its global dominance in active ingredients, intermediates, and finished pharmaceuticals — turning this position into a tool of geopolitical influence. The means that have led to this development are diverse, as the following overview illustrates.

How China Is Boosting Its Pharmaceutical Industry

Tax breaks for “high-tech enterprises”

Multi-billion-euro programs for research and development – including €2.8 billion for developing domestic drugs to treat ten major common diseases

Targeted market incentives and acquisitions of foreign companies

Protection of the domestic market – regulatory barriers for foreign suppliers and requirements to establish Chinese subsidiaries

Low-interest loans and easy access to capital – especially for generic drug manufacturers deemed strategically important (for example, antibiotic producers)

This dominant position now serves as a political lever: to achieve its political goals, China could withhold medicines — or, to avoid reputational damage, restrict the export of precursor substances.

It was precisely this risk arising from Europe’s dependency on China that EU health ministers had in mind when they described it in an open letter in spring 2025 as the “Achilles’ heel of our defense strategy.”

China’s Weapon: Economic Dependence

In recent years, China has demonstrated that it uses economic dependencies as a tool of foreign policy pressure — whether through rare earths, metals, raw materials, or medical protective equipment. The political message is clear: Those who oppose us risk economic harm.

So far, pharmaceutical products have not been withheld. However, state media, new laws, and internal strategy papers make it clear that the possibility of an export ban — for example, on critical precursor substances — is not a taboo in China but part of strategic planning.

In 2020, the state news agency Xinhua issued a stark warning directed at the United States: “An export ban will plunge you into the hell of a coronavirus…”

What an Export Ban Would Mean: The Stress Test

Since the COVID-19 pandemic at the latest, it has become clear how heavily Europe depends on China for medicines. This dependency is particularly evident at the level of active ingredients — most of them come from China, and without them, supply is impossible. Even greater risks become apparent when examining the origins of precursor materials and raw substances.

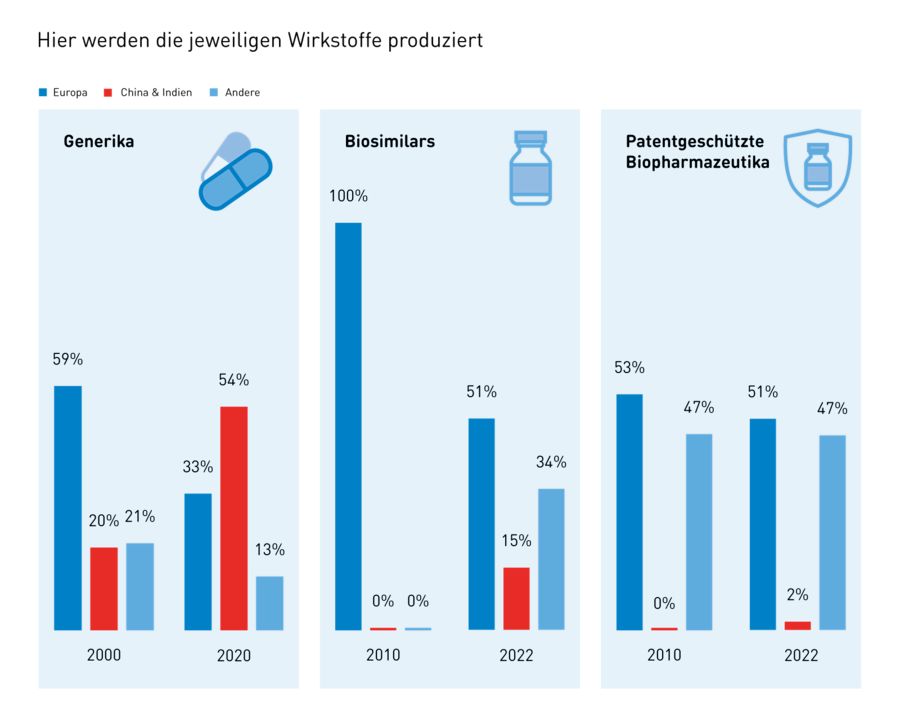

The dependency on China is particularly strong when it comes to generic drugs. The following chart illustrates this: in 2000, China and India together produced just over 20 percent of the world’s active ingredients for generics. By 2020, that share had risen to 54 percent. In contrast, the increase in recent years for biosimilars has been much smaller, and the situation for patented biopharmaceuticals has hardly changed between 2010 and 2022.

How dangerous it would be if China suddenly failed as a supplier is illustrated by an exemplary analysis of 56 supply-critical active ingredients — including painkillers, antibiotics, diabetes medications, and biosimilars. The study examined how strongly dependent we are on active ingredients from China, and thus the capacity risk in the event of a supply disruption.

In addition, for certain active ingredients, the researchers assessed how much we depend on precursor materials from China — which are essential for producing the active ingredients themselves.

Key Findings

At the active ingredient level, even the failure of a single Chinese producer could create severe supply gaps. This is particularly evident with antibiotics, but also with antidiabetic drugs. The authors describe the risk at this level as medium to high.

At the precursor level, the situation worsens significantly. Many raw materials come from only a few producers — often located in China. For example, the risk is particularly high for the precursors of the antibiotic Amoxicillin (6-APA), the antibiotic Cefpodoxime (7-ACA), and the antidiabetic Metformin (Dicyandiamide).

How We Became So Dependent: Politically Driven Price Regulation in Germany

Between the 1970s and the 2000s, the prices of generic drugs in Germany were increasingly regulated and reduced through various laws. The strain this placed on domestic production is illustrated by the case of penicillin: in 2002, 21 manufacturers still produced penicillin in Germany; by 2024, only six remained.

China’s Next Goal: Becoming the Market Leader in Biopharmaceuticals

For some time now, China has identified the biopharmaceutical sector as a strategic key industry. By 2035, it aims to transform itself from a pure production base into a global innovation powerhouse. This ambition is reflected in the “Made in China 2025” program, which defines biopharma as a core technology.

China’s 14th Five-Year Plan (2021–2025) also prioritizes biotechnology as a strategic growth area. This goal is not unrealistic — one milestone has already been reached: the number of Chinese biopharma patents now far exceeds those from Germany.

To achieve this, China again relies on targeted government support — while Germany, by contrast, is weakening domestic biopharmaceutical production through new austerity measures (such as treating biosimilars the same as generics). This trend is clearly illustrated in the following chart, showing how China has expanded its patent activity in recent years — particularly in biopharmaceuticals.

Impact on the Non-Patent Segment

This development also affects the non-patented market. Until the early 2010s, certain biosimilar active ingredients for the European market were produced exclusively in Europe. Today, however, more than one-third of the active ingredients required for manufacturing biosimilars approved in Europe are already being produced in Asia.

Want to know more? Read the full study (in German) here.